B2B is bigger than B2C

According to Mintel. That astounds me.

This year, I joined a B2B Marketing Agency. I was asked if I thought I’d struggle transitioning from working on mainly B2C clients to working on a mainly B2B clients. Here’s my answer?

Honestly, it’s a change. But I have been working with B2B brands on a retained basis for 8 years, and I’ve been selling B2B services (by working for an agency and a public sector organisation) for over a decade. Ultimately, what any customer wants, more than anything else, is to continually be delivered insight, by its suppliers, on how they could be saving or making money.

If you like that, you should read The Challenger Sale

Stats on business and B2B in the UK

But what is the state of the B2B industry in the UK. Let’s look at some existing research and statistics, to get a picture.

- The average UK gross income has grown double digits for a second consecutive year, rising by 14% to £5,475,964 (B2Bmarketing)

- IT and Telecoms is the strongest sector for B2B marketing agencies according to 68% of B2B agencies (B2Bmarketing)

- Content Marketing was the one activity that businesses believed would make the greatest impact in 2018 (Experian)

- 2018 saw a 28% increase in businesses using video marketing (Experian)

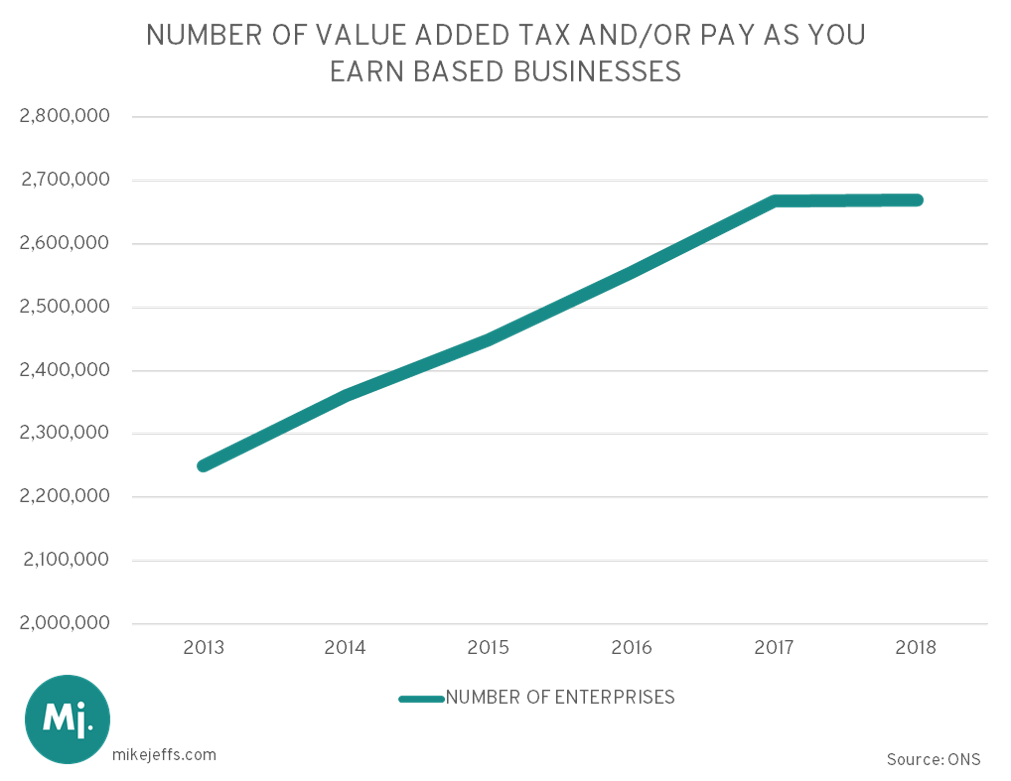

- 2018 saw the first year on year fall in the number of businesses since 2000. (BEIS, UK Parliament)

- The largest industry group of UK companies is professional, scientific and technical, making up 17.5% of all registered businesses in the UK (ONS)

- Unsurprisingly, London remains the region with the largest number of businesses, representing 19% of the UK total (ONS)

- The marketing industry generates £36.5bn in the UK and employs 415,000 FTEs. (PWC)

- To put that last one in context, the UK ranks fourth among the world’s largest advertising markets, and first among markets in Europe. (Statista)

Predicted B2B trends

So what does that mean for B2B? Where is the market going? What are the trends?

- The market for the entire B2B media, business and company information is projected to grow to over £65.1bn by 2020, from £58.7m estimated for 2016. (Statista)

- By 2020, 90 percent of large enterprises will be running custom machine learning applications, compared with just five percent of small and medium businesses. (Business Leader)

- 2019 will see formal competition in speech assistants for the enterprise and workplace markets. Rising usage in homes, home offices and in corporate meeting rooms encourages greater focus on business scenarios for Microsoft’s Cortana, Amazon’s Alexa and Google’s Assistant. (Business Leader)

- By 2021, it will be possible to talk to almost every new connected consumer device sold in western markets. (Business Leader)

- Trust is the most important source of competition among cloud service providers in 2019. (Business Leader)

Changing trends and consumer currency

The last stat (among many great ones from Business Leader), for me is the really interesting one.

3-4 years ago we were writing about fintech, how the biggest factor in finance is trust, and how the characteristics of startups vs traditional banks could be used to reset customer expectations.

Consumers crave openness and accessibility to their money.

Consumers now also crave an openness and accessibility to their data.

Companies have a lot of consumer data.

Companies also have a lot of data about other companies.

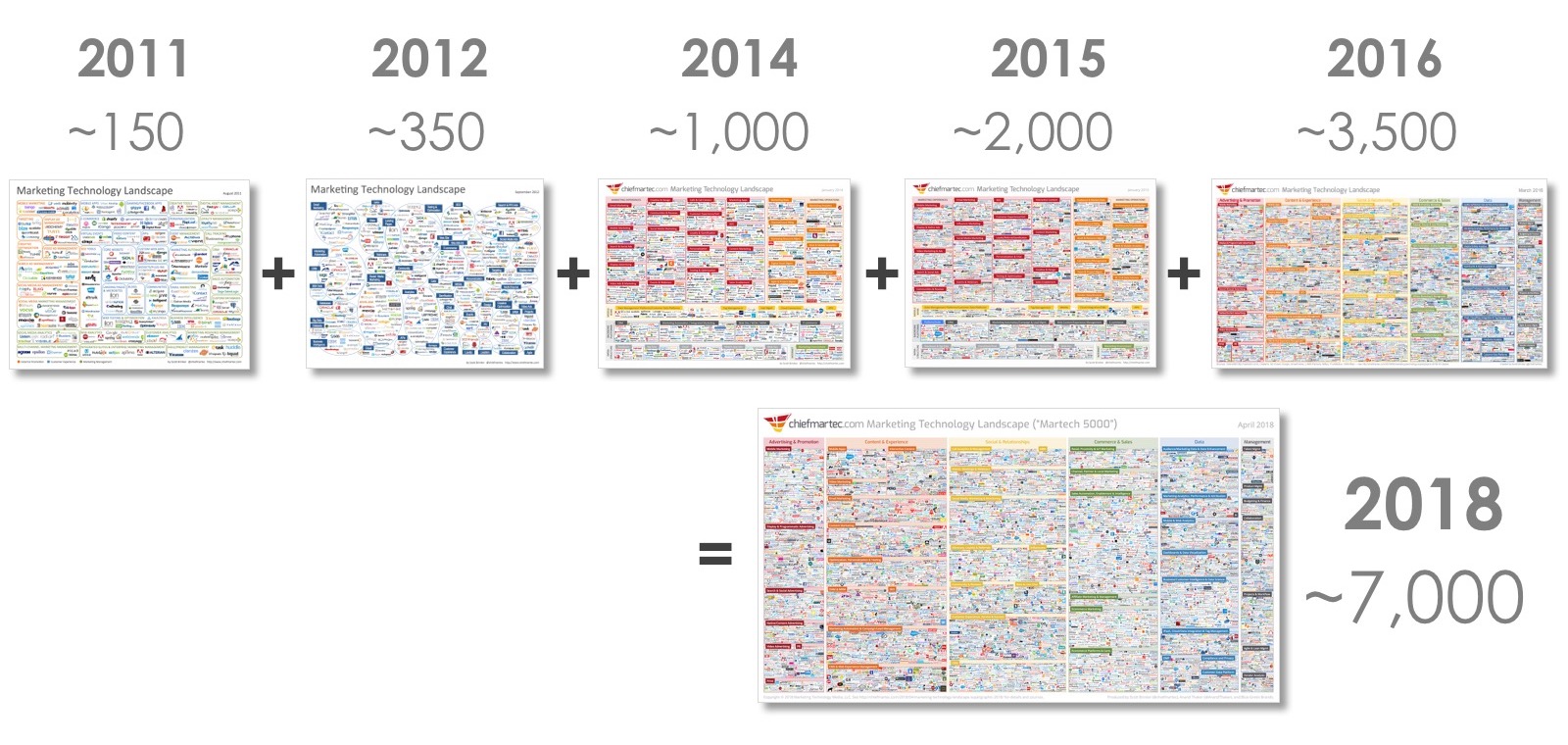

You may be familiar with Scott Brinker’s marketing technology landscape supergraphic. Last year that graphic grew 27%:

Companies want to build up a better picture of their consumers in order to match the continually increasing expectations and desired experiences that those consumers have. So data, but also how data feeds can intertwine, is critical to building a true vision of the consumer – what they need and when they need it.

For B2B companies, these trends mean building a more complex picture. The buying process in B2B is different and so aligning data has to be where B2B organisations are investing. According to LinkedIn, technology purchasing can involve anything up to 4.5 departments before a business commits to a contract. Departments that often aren’t nimble and often aren’t visible to the seller for very long:

The final decision-maker may not be the person doing the assessment and testing, and he or she may only have a momentary presence during the entire buying experience. They may kick off the process and show up at the end, but somebody else is doing the grunt work in between. Even so, you’ve still got to educate and sell them when they eventually show up.

The challenge for B2B marketers and business for 2019 is setting up data sources, contextualising those data sources across an organisation and ultimately proving the link between correlation and causation for the bottom line.

Victor Garcia